Financial advice is expensive.

That’s not an uncommon view. And viewed purely in monetary terms, financial advice IS expensive.

But what if we told you that it can be less expensive than not getting financial advice?

Research over the past few years has shown that good financial advice can save you much more than it costs you.

A 2019 report by Vanguard estimated that clients who are advised (rather than those who invest money via online platforms or under their own steam) can add around 3% to their overall returns.

The International Longevity Study reckoned that your pension pot can be 50% bigger as a result of working with a financial planner on a long-term basis.

How can talking to an adviser make that much difference?

Spoiler alert: it’s not because we have the inside track to the hot performing stocks and shares. We have no more idea than you do when Elon Musk is about to declare his fondness for a new cryptocurrency, and we can’t spot the next GameStop. (Don’t believe others if they say they can.)

There are four key reasons why professional financial planning is worth paying for.

1. We turn dreams into goals

A financial planner starts by finding out what you’re looking to achieve with your money. What are your long-term goals? Where are you now, and where do you want to be in the future?

Rather than just building an investment portfolio that hopes to gain X% per year, we help you articulate what you want your money to do for you – let you retire at 55, travel extensively, build your ideal home from scratch… whatever.

Then, we look at your income and outgoings, assets and liabilities, and work out a plan that turns your dreams into achievable goals. If you want to take a round-the-world trip in ten years’ time, buy a home for your children to live in when they’re at university, upgrade your family car every three years, sell your business in five years, we factor that into the plan and create a route map that builds in those destinations along the way.

This doesn’t mean waiting for the good times to arrive. Life is for living, so your plan will allow you to do want you want now, without worrying that you’re jeopardising your future goals.

Why is this worth it?

When you have a target to hit, you’re less likely to lose focus. You know what you’re working towards and, more to the point, you know you can achieve it and how you can achieve it. You’re not just investing and hoping for the best.

2. We manage your tax

Managing your finances isn’t just about what you invest and spend. All of us above a certain level of income have to pay tax. It’s part of our job to ensure your tax obligations are fulfilled while minimising your outgoing costs.

By carefully structuring your finances, we ensure you make the most of your allowances for income and capital gains tax, dividends, ISAs, pensions and other tax wrappers.

3. We take appropriate levels of risk

Given that there’s a wealth of evidence about what works and what doesn’t when it comes to investing in the stock market, it’s frankly incredible that many financial professionals still advocate treating portfolio management like a trip to the casino.

A good financial planner will choose carefully where to put your money and base their decision on peer-reviewed research. We call it evidence-based investing because that’s what it is: investing based on evidence, not a hunch or some special human stock-picking skill that hits the heights one year and fizzles out the next.

Your portfolio is structured to deliver the goals you want to achieve. It balances risk: spreading investment in different asset classes and global markets. So although we’d expect the asset classes in your portfolio to deliver positive returns in the long run, they will inevitably perform quite differently over short periods.

4. We save you from yourself

However much you think everything is in control, there will always be something that comes along that looks set to derail all your plans. Stock market crashes, freak weather, wars and pandemics – those four horsemen of the apocalypse have each hit the world more than once in the last couple of decades.

It’s understandable, when you hear news reports of the ‘biggest stock market fall for a century’, to want to sell up to avoid losses.

But look at history.

In the vast majority of cases, stock market crashes are followed fairly rapidly (in investing terms) by stock market recoveries.

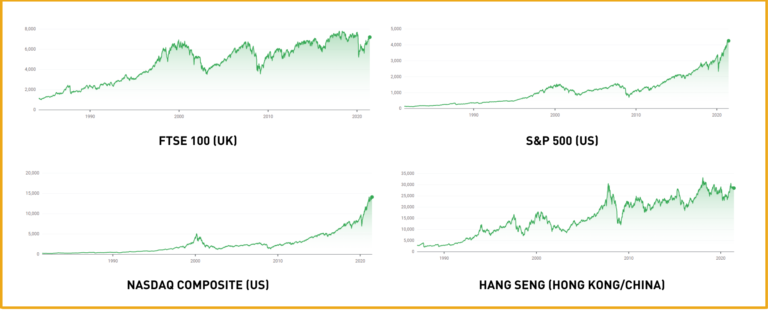

Here are four key stock market indices over a 30-40 year period. Bear in mind this timescale includes Black Monday (1987), the Dotcom Bubble of the early 2000s, the Global Financial Crisis of 2008-9 and Coronavirus (2020).

You can see that the key markets are on a long term upward trajectory and recovered fairly quickly from all four of the most recent crashes.

Now imagine if you’d panicked in February 2020 when markets everywhere went into freefall. If you’d sold in response to that, you would have missed the gains you can clearly see since then – especially in the US, where most of the big tech stocks that have soared in the pandemic (think Amazon, Microsoft, Zoom etc.) are based.

It’s hard to hold on when everyone else is selling or be circumspect when everyone else is buying. It’s the job of a financial planner to ‘hold your hand’ through these wobbles, however dramatic they may seem at the time, and help you avoid making expensive mistakes.

With a globally diversified portfolio held over the long term, most of our clients will have seen the benefits of these gains.

When we ask our clients the main reason they use a financial planner, they tell us it’s peace of mind, clarity for the future and the confidence to retire earlier than they ever thought possible.

And if that isn’t worth talking to a professional, we don’t know what is.