Have you ever wondered why some people seem to have a knack for picking winning stocks while others struggle to make any headway in the market? The answer might surprise you – and it's all down to something called the "random walk" theory.

What's a Random Walk?

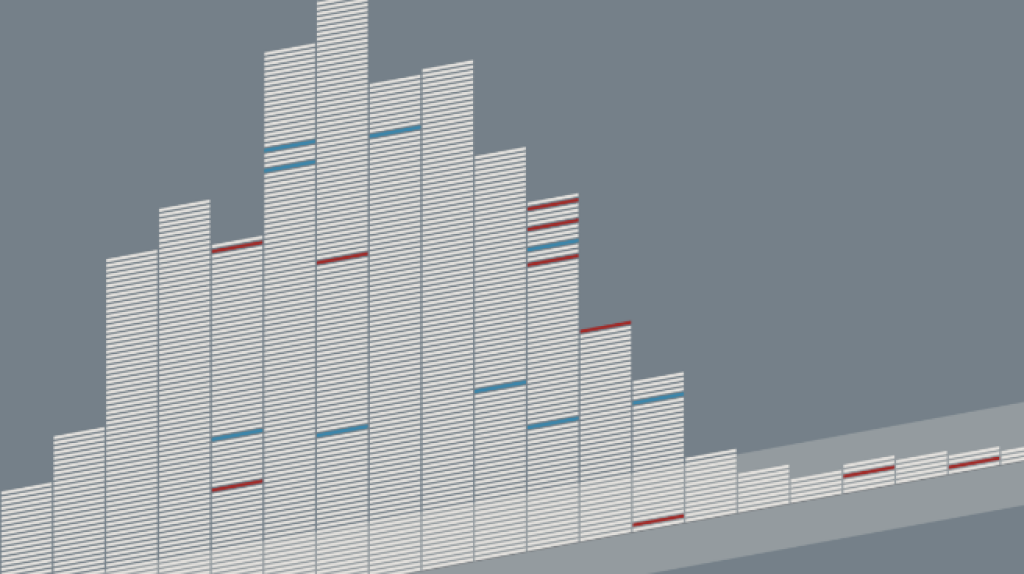

No, we're not talking about a leisurely stroll through the park. In the world of finance, a random walk refers to the idea that stock prices move unpredictably, like a drunk person stumbling home after a night out. Each step (or price change) is random and independent of what came before.

Why Should You Care?

This concept might seem a bit abstract, but it has huge implications for how we approach investing. Here's why:

Your crystal ball might be broken: If stock prices truly follow a random walk, then trying to predict short-term market movements is about as effective as using a crystal ball. Those "hot tips" from your mate down the pub? Probably not worth much.

The long game matters: While day-to-day price changes might be unpredictable, the random walk theory doesn't rule out long-term trends. This means focusing on the big picture could be more rewarding than obsessing over daily fluctuations.

Diversification is your friend: If individual stocks are dancing to their own random tune, spreading your investments across many different companies can help smooth out the bumps.

What Does This Mean for You?

If you're scratching your head wondering how to apply this to your own finances, don't worry. Here are some practical takeaways:

Consider index funds: These funds aim to track the overall market rather than beat it. If the market truly is random in the short term, this approach makes a lot of sense.

Think twice about day trading: The random walk theory suggests that trying to profit from short-term price movements is more like gambling than investing.

Don't put all your eggs in one basket: Diversification isn't just a fancy word – it's a strategy backed by solid theory.

Be wary of "expert" predictions: Even the pros can't consistently predict short-term market movements if they're truly random.

The Bottom Line

The random walk theory doesn't mean investing is pointless. Far from it! It simply suggests that our approach to investing might need a rethink. By focusing on long-term growth, diversification, and resisting the urge to react to every market hiccup, you might find your financial journey becomes a lot less stressful – and potentially more rewarding.

Remember, in the world of investing, slow and steady often wins the race. So maybe it's time to embrace the random walk and enjoy the journey, rather than trying to predict every twist and turn along the way.

What do you think? Does the random walk theory change how you view investing?